Decent shelter is something we all need.

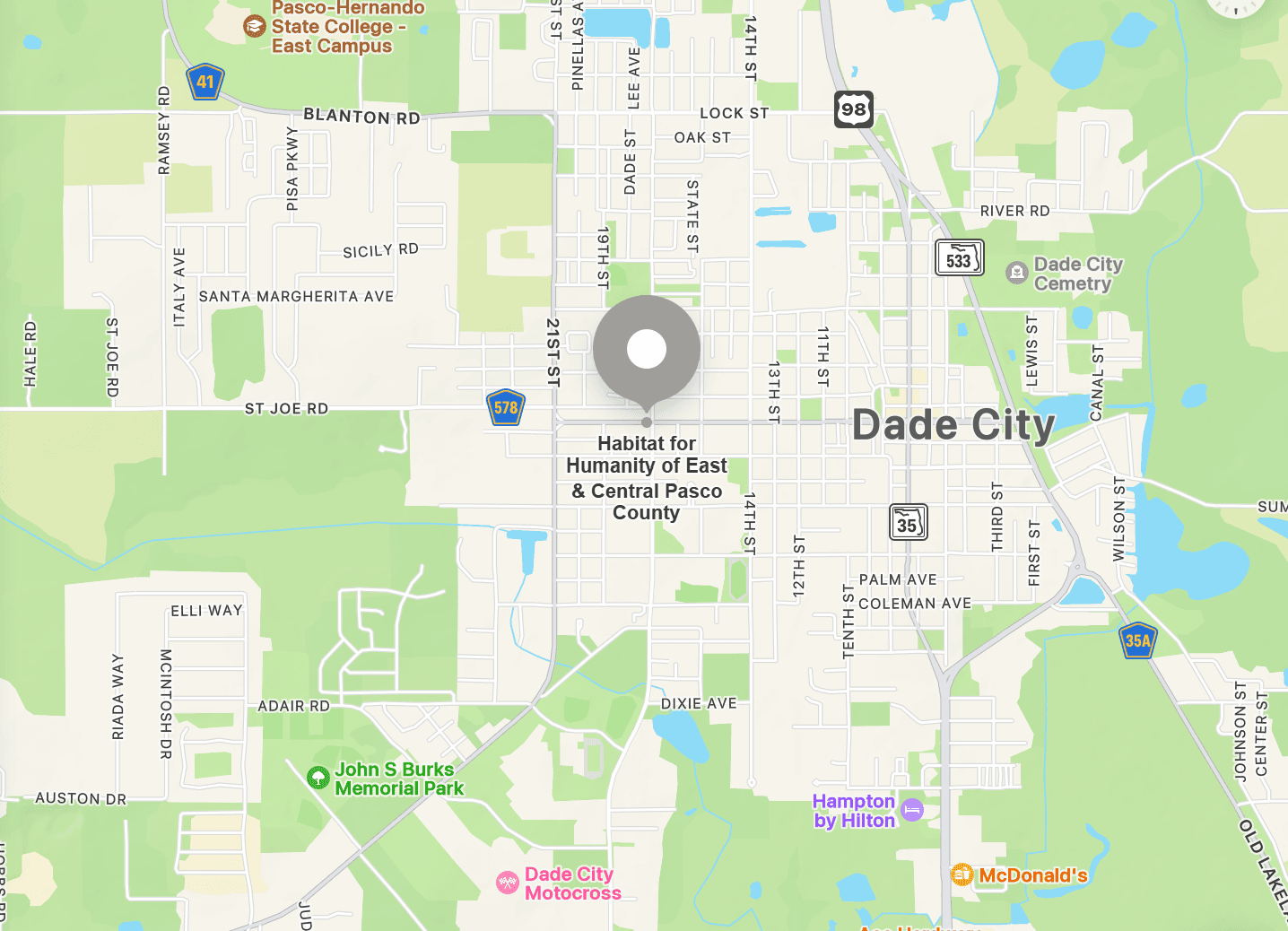

Habitat for Humanity of East and Central Pasco County builds alongside families and individuals in communities like Zephyrhills, Dade City, Wesley Chapel, Land O’ Lakes, San Antonio, Lacoochee, St. Leo, and nearby neighborhoods to make safe, stable, and affordable homeownership possible.

Habitat is not a giveaway program.

Our homebuyers purchase their homes, gaining equity, stability, and a brighter future. More than just building houses, we’re building partnerships. If you're ready to take the next step toward affordable homeownership, we’re ready to walk alongside you—every step of the way.

Homebuyer partner review process

Need for better housing

A demonstrated need for better housing—this might mean your current housing is unsafe, overcrowded, or unaffordable. We understand that many individuals and families face housing challenges due to circumstances beyond their control. You may be in need of a safe, stable home if you’re currently experiencing:

- Unpredictable rent increases

- Overcrowded living conditions

- Damaged or poorly maintained housing

- Unsafe neighborhoods

- Limited access to land or affordable financing

- A lack of homes within your financial reach

Ability to repay

The ability to repay an affordable mortgage, which will not exceed 30% of your gross monthly income, this means a stable income that meets the income HUD guidelines (see income requirements table above). Each mortgage is tailored to what the buyer can afford, and any subsidy is provided as a zero-interest, forgivable second mortgage.

Future homebuyers must:

- Have had a steady income for at least two years

- Meet income guidelines and maintain a manageable debt-to-income ratio

- Have reasonably good credit—perfect credit isn’t required

- Show a consistent ability to make payments on time

If your credit needs improvement, that’s okay. We can connect you with trusted resources. We’re here to walk alongside you on the journey to affordable homeownership—one step at a time, together.

Willingness to partner

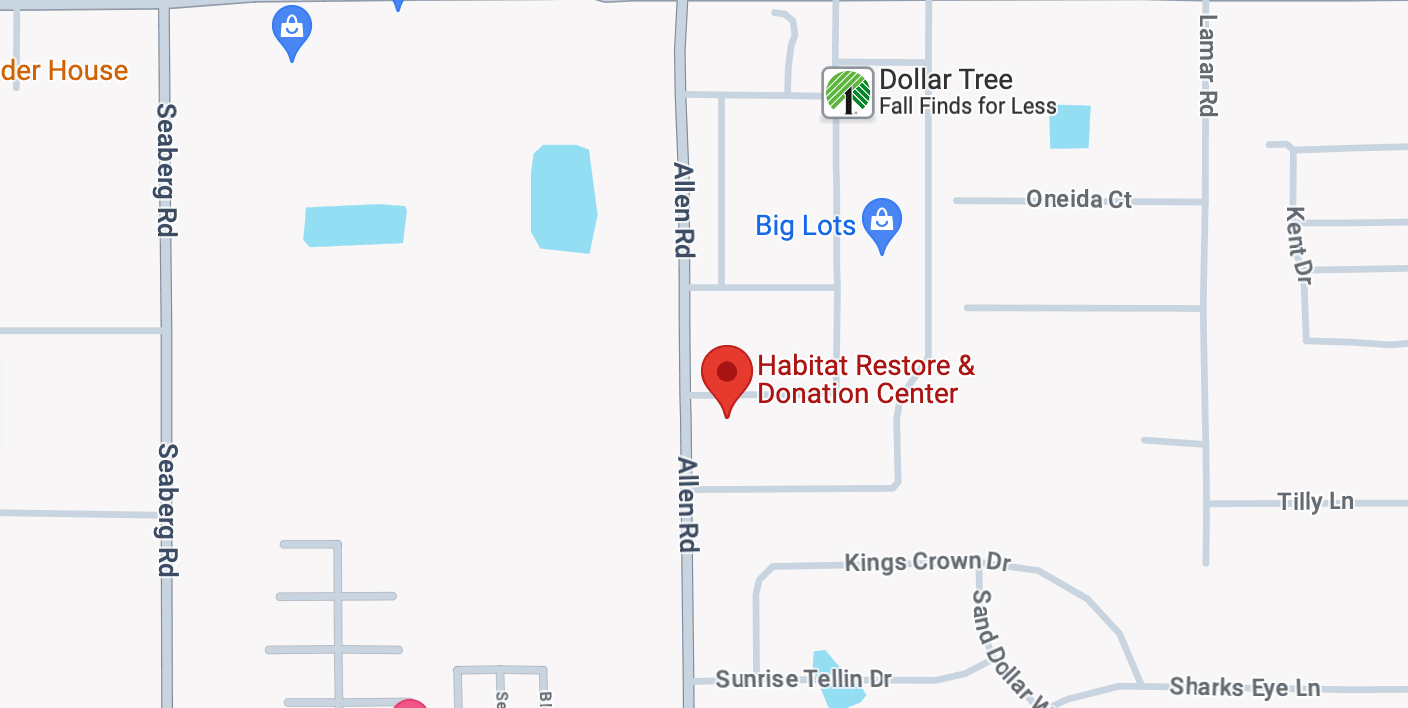

A willingness to partner with us by completing sweat equity hours, which can include building your home, working in our ReStore, or attending homebuyer and financial education sessions

We believe in building more than homes—we build partnerships with individuals and families who are committed to creating stronger communities. Our homebuyer partners are people who share in our mission of community reinvestment and are ready to actively participate in the journey toward homeownership.

Once selected, homebuyer partners complete up to 400 hours of sweat equity, which may include helping build homes (your own and others'), volunteering at a Habitat ReStore, or participating in homeownership and financial education classes.

Additional considerations

Completion of a Pasco County homebuyer education class

As part of our commitment to setting homebuyers up for long-term success, we connect our future homeowners with a HUD-certified Pasco County homebuyer education class. This 8-hour course equips future homeowners with the tools and knowledge needed for sustainable homeownership. Completion of this course may also be required depending on grant requirements and mortgage financing. This 8-hour course is:

- Mandatory for all borrowers seeking local, state, or federal down payment assistance

- If required before closing, must be completed within two years of your home’s closing date

- Open to the public and can be taken before or after applying with Habitat

- These classes are in all areas of the County. Spanish language classes are also available.

To register for our classes, please contact Suncoast Housing Connections (Tampa Bay Community Development Corporation) at 727-442-7075 or register online.

Qualifying for a loan with one of our partner agencies

If you're applying for a USDA 502 loan through our program, please note:

- A $30 cashier’s check (made payable to USDA) is required to cover your credit check. This is only for the USDA application, not the Habitat application.

- A cash requirement of approximately $1,000 (usually covering the first year of insurance) is typically needed. This can be paid over time before your home closing.

We understand that not everyone will meet the criteria for our homeownership program. If you're not currently eligible, we encourage you to explore other affordable housing options by visiting www.FloridaHousingSearch.org, a helpful resource for finding affordable rental and homeownership opportunities across the state.