Frequently asked questions

-

Can I apply if I’m single, don’t have children, or am disabled or retired?

Yes. We are an equal housing opportunity provider and do not discriminate based on family status, disability, or marital status. You may apply as long as you meet our three main criteria:

- Need for housing

- Ability to repay the mortgage

- Willingness to partner with Habitat for Humanity

-

Can I apply with an Employment Authorization Document (EAD)?

No. You must be a U.S. citizen or have a valid permanent resident card (green card).

-

Can I apply if only one spouse is a citizen or permanent resident?

No. Both spouses must meet the citizenship or residency requirements.

-

Can I apply if I’m separated but not legally divorced?

No. You must have a finalized divorce decree to apply.

-

I recently started a new job. How long must I be employed before applying?

At least three months with your new employer. If changing roles within the same company, you may apply immediately.

-

Does child support count toward income?

Yes, if court-ordered and consistent. Informal or undocumented payments do not count.

-

Are food stamps counted as income?

No. Food stamps are not considered income for application purposes.

-

Can I apply if I previously owned property?

Yes, if it’s been at least three years since the property was sold or transferred.

-

Can I apply if I’ve filed for bankruptcy?

Yes, depending on the type:

- Chapter 7: Three years after discharge

- Chapter 13: Seven years after discharge

-

Do you look at my credit score? Is there a minimum?

Yes, but the score itself isn’t a deciding factor. We review credit history and debt-to-income (DTI) ratio.

-

Will issues like collections or student loans affect my application?

Possibly. A strong repayment history is important.

-

How long after approval will I move into my home?

Typically 8–12 months, but timelines vary based on availability and completion of requirements.

-

Do I get to choose my home’s location?

Yes, from available inventory once program requirements are partially completed.

-

How much will I pay monthly?

Payments are tailored to your income and will not exceed 30% of monthly income.

-

Are Habitat homes part of an HOA?

Some new homes are in subdivisions with HOAs or COAs, though some may not be.

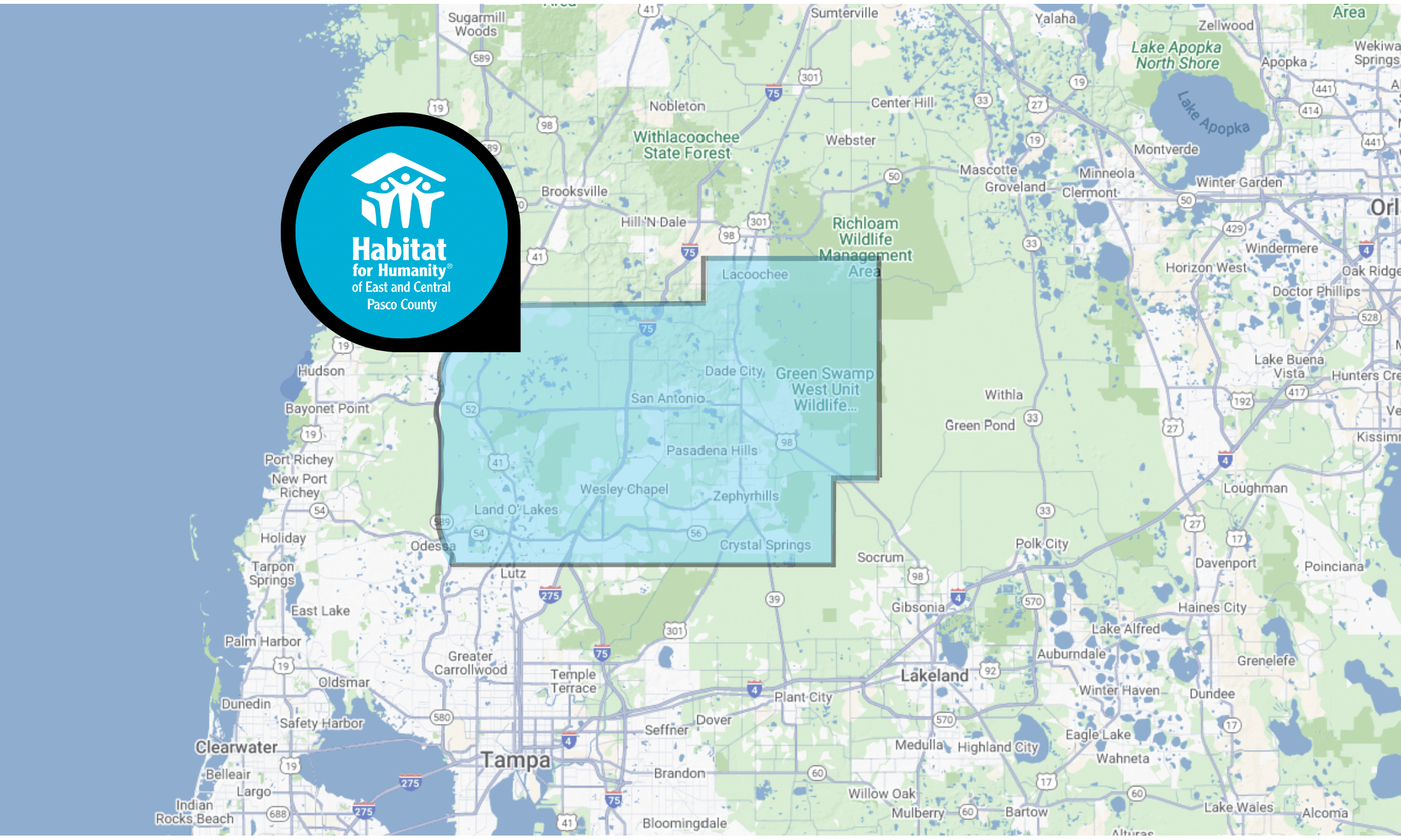

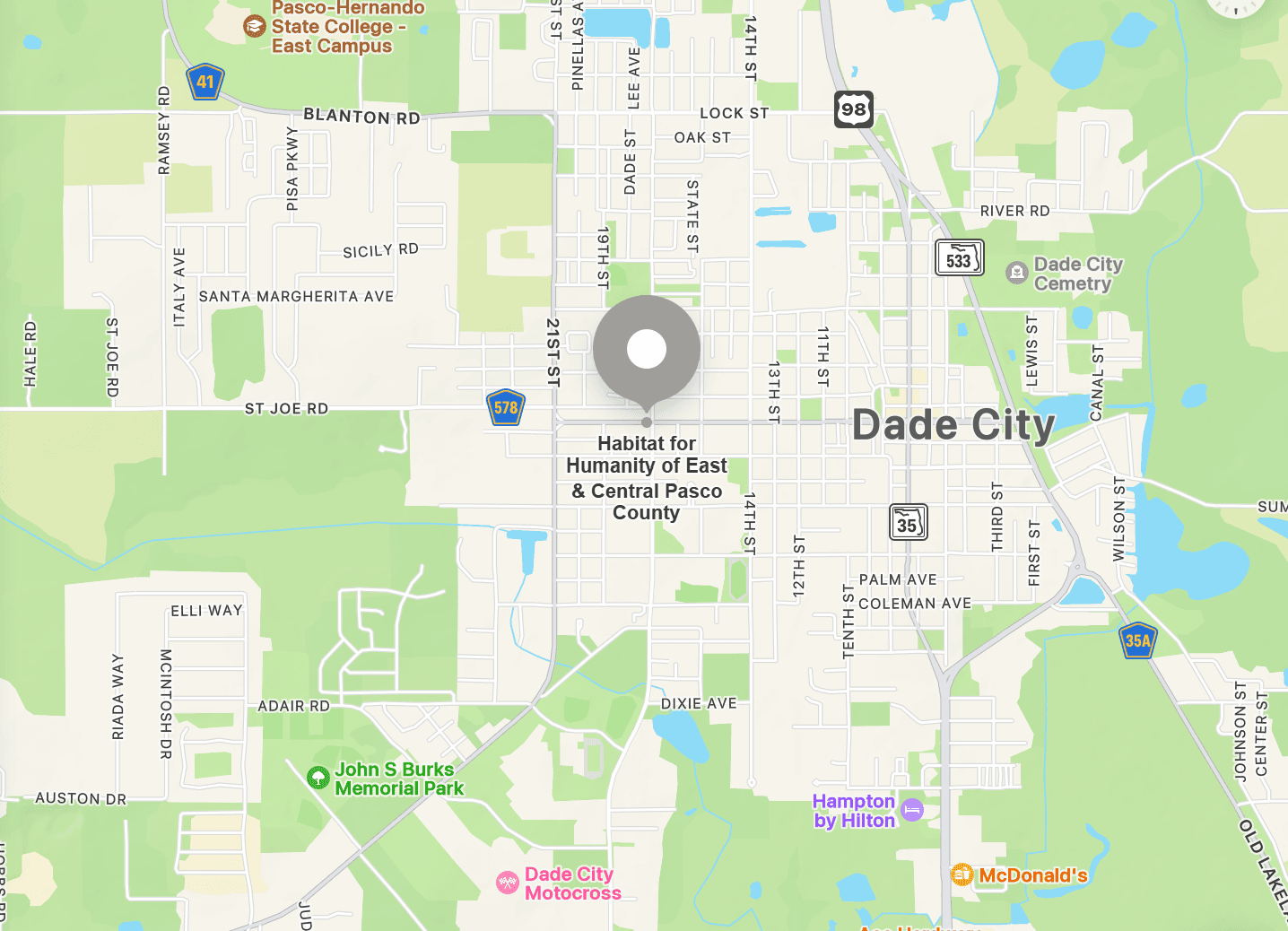

Where we build

Our service area includes Pasco County east of the Suncoast Parkway, we have built in areas such as: Zephyrhills, Dade City, Wesley Chapel, Land O’ Lakes, Spring Hill, Crystal Springs, and Lacoochee.

General Eligibility

Can I apply if I’m single, don’t have children, or am disabled or retired?

Yes. We are an equal housing opportunity provider and do not discriminate based on family status, disability, or marital status. You may apply as long as you meet our three main criteria:

- Need for housing

- Ability to repay the mortgage

- Willingness to partner with Habitat for Humanity

Can I apply with an Employment Authorization Document (EAD)?

No. You must be a U.S. citizen or have a valid permanent resident card (green card).

Can I apply if only one spouse is a citizen or permanent resident?

No. Both spouses must meet the citizenship or residency requirements.

Can I apply if I’m separated but not legally divorced?

No. You must have a finalized divorce decree to apply.

Employment and Income

I recently started a new job. How long must I be employed before applying?

At least three months with your new employer. If changing roles within the same company, you may apply immediately.

Does child support count toward income?

Yes, if court-ordered and consistent. Informal or undocumented payments do not count.

Are food stamps counted as income?

No. Food stamps are not considered income for application purposes.

Property Ownership and History

Can I apply if I previously owned property?

Yes, if it’s been at least three years since the property was sold or transferred.

Can I apply if I’ve filed for bankruptcy?

Yes, depending on the type:

- Chapter 7: Three years after discharge

- Chapter 13: Seven years after discharge

Credit and Debt

Do you pull my credit score? Is there a minimum?

Yes, but the score itself isn’t a deciding factor. We review credit history and debt-to-income (DTI) ratio.

Will issues like collections or student loans affect my application?

Possibly. A strong repayment history is important.

Homeownership

How long after approval will I move into my home?

Typically 8–12 months, but timelines vary based on availability and completion of requirements.

Do I get to choose my home’s location?

Yes, from available inventory once program requirements are partially completed.

How much will I pay monthly?

Payments are tailored to your income and will not exceed 30% of monthly income.

Are Habitat homes part of an HOA?

Some new homes are in subdivisions with HOAs or COAs, though some may not be.